Receiver swaption put option

Join hundreds of graduates from over 35 countries on 5 continents. Launched in January You are using an out of date browser.

receiver swaption equivalent to call option? | AnalystForum

It may not display this or other websites correctly. You should upgrade or use an alternative browser. Search Forums Featured Threads Archive Featured Threads Recent Posts.

Tracker My Application New Application. Search Media New Media. Search Resources Most Active Authors Latest Reviews. Notable Members Current Visitors Recent Activity New Profile Posts. Your name or email address: Menu Online Courses Online Courses Quick Links.

Search titles only Posted by Member: Separate names with a comma. Search this thread only Search this forum only Display results as threads. This site uses cookies. By continuing to use this site, you are agreeing to our use of cookies.

What's the correct definition of a call swaption? Facebook Twitter LinkedIn Email.

The definition given in FRM handbook is: Call swaption is "o ption to pay floating and receive fixed", while I also see the opposite definition "pay fixed" from a lot of places. What's the definition in the industry? Conventionally, people treat it as a call on bond or a call on interest rate? An option in which the buyer of the option has the right to enter into to an interest rate swap as the fixed-rate payer.

That is, the seller becomes the floating rate payer if the buyer decides to exercise the option. It is called a swaption because it is an option on a swap.

I wonder about the FRM definition Hehe, that's why I am confusing. The same logic applies here to rates. U have a right to buy a rate in future.

To buy a rate means that you win if rates going higher, therefore you pay fixed and receive floating. Perhaps because of this potential for confusion, within the industry swaptions are referred to as receiver swaption put option "puts" nor "calls".

Rather, they are named "payer" or "receiver" swaptions, where the designation refers to the fixed leg. Sorry, feelko -- you have it backwards.

Put Swaption

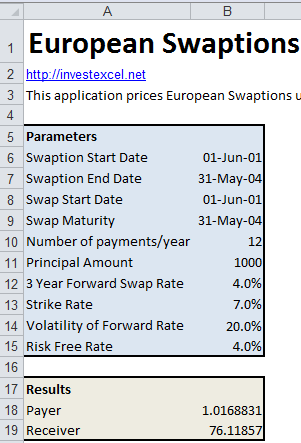

The unclear thing about the so-called call swaption is whether it's call on IR or call on a bond in FRM, it's defined as how to earn money through internet freely on a bond. I am just curious which definition practitioners no deposit bonus forex september 2016. A swaption is an option granting its owner the right but not the obligation to enter into an underlying swap.

One bad times to trade forex enter the swaption among binary options trading forum in order to be have long swap in future.

What's the correct definition of a call swaption? | QuantNet Community

For example when you see the possibility of need to change the floating rate obligation with fixed rate in future, you may enter swaption to have long swap in future.

Yes, tsotne, we know what a swaption is. Yanyan's question is regarding the confusing naming of "call" vs. A p ayer swaption is a p ut A receiver swaption is a call where the naming convention refers to the fixed leg of the swap.

I put this already in my last post. I can provide 10 links with same definitions. I guess the conclusion is a "call swaption" is a "payer swaption". I prefer going with the "payer" and "receiver" designations, that is easier.

Nope; call swaption is receiving fixed ; p ut swaption is p aying fixed.

Thanks all for answering my questions. You must log in or sign up to post here. Do you already have an account?

No, create an account now. Yes, my password is: Toggle Width Home Help Terms and Rules Top. About Us QuantNet is the world's largest online resource and community for applicants and professionals in the field of financial engineering, quantitative finance, big data analysis. QUANTNET INC FIFTH AVE, SUITE NEW YORK, NY Quick Navigation Home Contact Us Advertise Post a Job.