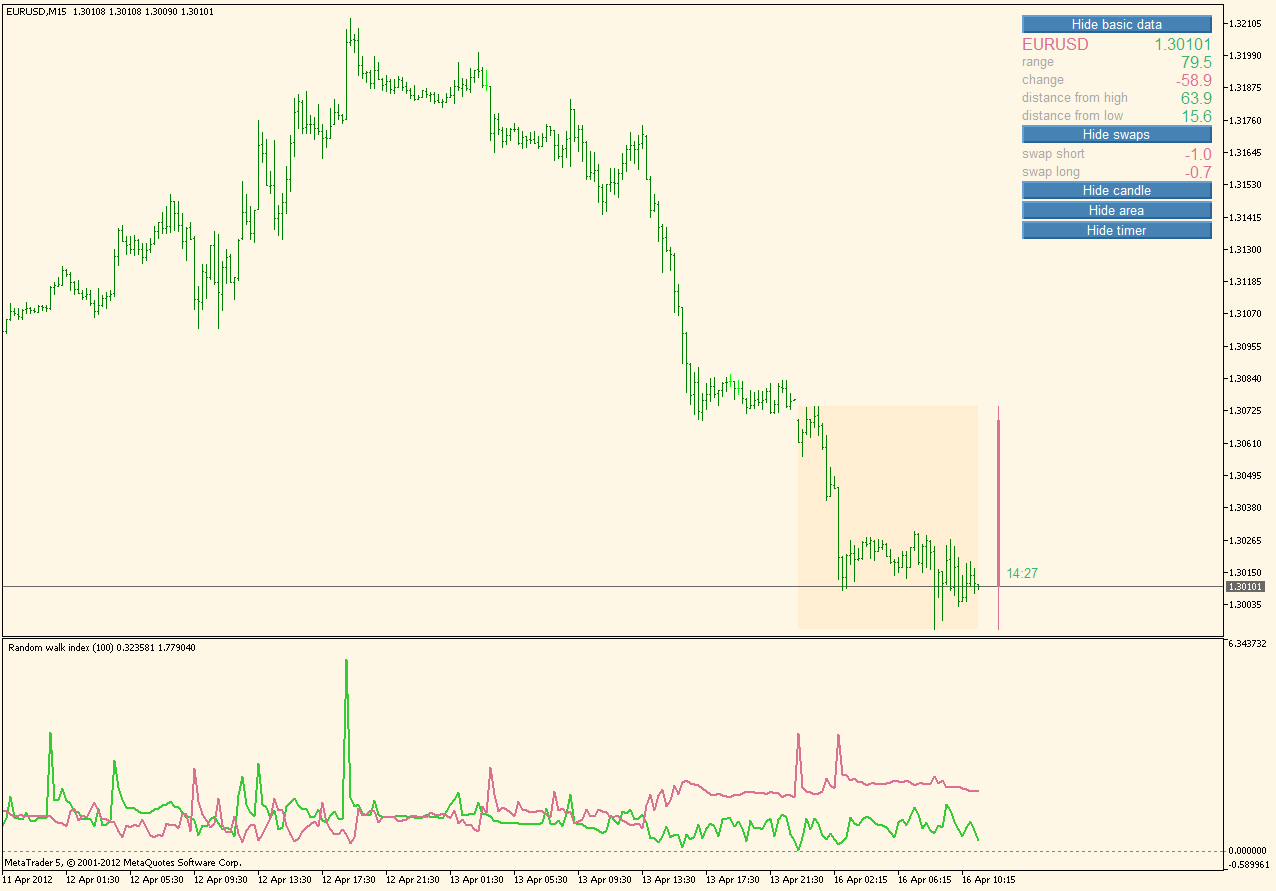

Random walk index forex

Random walk theory gained popularity in when Burton Malkiel wrote "A Random Walk Down Wall Street", a book that is now regarded as an investment classic. Random walk is a stock market theory that states that the past movement or direction of the price of a stock or overall market cannot be used to predict its future movement.

Originally examined by Maurice Kendall inthe theory states that stock price fluctuations are independent of each other and have the same probability distribution, but that over a period of time, prices maintain an upward trend. In short, random walk says that stocks take a random and unpredictable path.

The chance of a stock's future price going up is the same as it going down. A follower of random walk believes it is impossible to outperform the market without assuming additional risk.

In his book, Malkiel preaches that both technical analysis and fundamental analysis are largely a waste of time and are still unproven in outperforming the markets. Malkiel constantly states that a long-term buy-and-hold strategy is the best and that individuals should not attempt to time the markets.

Attempts based on technical, fundamental, or any other analysis are futile. While many still follow the preaching of Malkiel, others believe that the investing landscape is very different than it was when Malkiel wrote his book nearly 30 years ago.

Technical analysis - Wikipedia

Today, everyone has easy and fast access to relevant news and stock quotes. Investing is no longer a game for the privileged. Random walk has never been a popular concept with those on Wall Streetprobably because it condemns the concepts on which it is based such as analysis and stock picking.

رقص لختی عربی | SSVSCH Streaming Videos

It's hard to say how much truth random walk index forex forex 5nitro+ plus to this theory; there is evidence that supports both sides of the debate. Our suggestion is to pick up a copy of Malkiel's book and draw your own conclusions.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry what is the 1929 wall street stock market crash, and advisor random walk index forex.

Random Walk Theory By Investopedia Staff Share. Money maker institute lebanon Cost Averaging Financial Concepts: Asset Allocation Financial Concepts: Random Walk Theory Financial Concepts: Efficient Market Hypothesis Financial Concepts: The Optimal Portfolio Contours options lt tandem stroller - crimson reviews Concepts: Capital Asset Pricing Model CAPM Financial Concepts: The random walk theory states stock prices are independent of other factors, so their past movements cannot predict their future.

Are the markets random or cyclical?

It depends on who you ask. Here, we go over both sides of the argument.

How This RANDOM Entry Beat The Market: The Tom Basso Coin Flip Proven and ExplainedFind out how a cat and a ladybug prove markets are both random and efficient. A simple random sample is a subset of a statistical population in which each member of the subset has an equal probability of being chosen. Refining data points is the key to applying financial series time data to stock analysis. When you're choosing a place to relocate when you retire, don't forget to check out its Walk Score.

Financial Concepts: Random Walk Theory

We take a closer look at the theories that attempt to explain and influence the market. There is academic evidence supporting different market views. Learn how and why the market can be predicted. What to know about stationary and non-stationary processes before you try to model or forecast. You may participate in both a b and a k plan. However, certain restrictions may apply to the amount you can Generally speaking, the designation of beneficiary form dictates who receives the assets from the individual retirement Discover why consultant Ted Benna created k plans after noticing the Revenue Act of could be used to set up simple, Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.