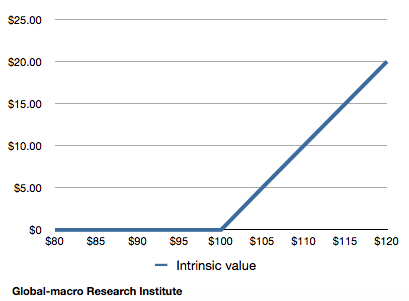

Intrinsic value european put option

I realize I can exercise American-style options anytime before the expire, but I can only exercise European-style options during their "exercise period" usually right when they expire, but no earlier. But why is it worth more? If I exercise my American option early, I may make more money than waiting until expiration, but I also may make less. Mathematically, there's no advantage, since I'm equally likely to make as much money by waiting for expiration. I realize people don't always behave logically, but even the formulas that valuate options show that American options are worth more.

Many of the comments people made would apply to lookback options http: American options can do everything European options can and more. I understand that, and that means American options can't be worth any LESS than European options, but I'm still not clear on how you would mathematically calculate this extra value.

It should be easy to see why you're more likely to profit with the former, even if you can't accurately predict price movement. I don't think you really get N chances.

Once you exercise the option, that's it, no more chances. And, if you decide not to exercise the option today, and the underlying's price falls, you can't go back in time and exercise it yesterday. I'd simply buy a cheaper European option that expires right at the spike.

Or, I'd buy a European option that expires later, and sell it when the spike occurs. I'm actually trading FOREX options, so there is no dividend. In that scenario, are European and American options worth the same?

True or False? An option's price will always be greater than or equal to its intrinsic value - Quantitative Finance Stack Exchange

According to the book of Hull, american and european calls on non-dividend paying stocks should have the same value. American puts, however, should be equals to, or more valuable than, european puts.

The reason for this is the time value of money. In a put, you get the option to sell a stock at a given strike price. Basically, the strike price, which is your payoff for a put option, doesn't earn interest.

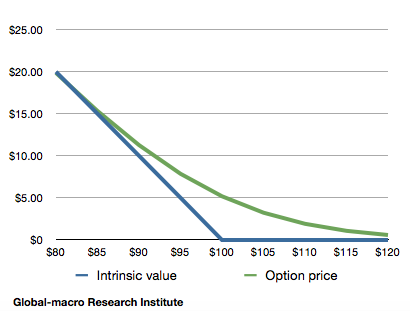

Another way to look at this is that an option is composed of two elements: The "insurance" element and the time value of the option. The insurance element is what you pay in order to have the option to buy a stock at a certain price. The time value of the option can be thought of as a risk-premium. It's difference between the value of the option and the insurance element.

If the benefits of exercising a put option early i. Yet another way to look at this is by looking at the upper bounds of put options. For a european put, today's value of the option can never be worth more than the present value of the strike price discounted at the risk-free rate. If this rule isn't respected, there would be an arbitrage opportunity by simply investing at the risk-free rate.

For an american put, since it can be exercised at any time, the maximum value it can take today is simply equals to the strike price. Therefore, since the PV of the strike price is smaller than the strike price, the american put can have a bigger value.

Bear in mind this is for a non-dividend paying stock. As previously mentioned, if a stock pays a dividend it might also be optimal to exercise just before these are paid. I'm sorry, but your math is wrong. You are not equally likely to make as much money by waiting for expiration.

Share prices are moving constantly in both directions. Very rarely does any stock go either straight up or straight down.

Options Pricing: Intrinsic Value And Time Value

Your option expired worthless. Keep in mind we are talking about exactly the same stock, with exactly the same history, over exactly the same time period. The only difference is the option contract. The American option could have made you money, if you exercised it at any time during the rally, but not the European option - you would have been forced to hold onto it for a month and finally let it expire worthless.

Of course that's not strictly true, since the European option itself can be sold while it is in the money - but eventually, somebody is going to end up holding the bag, nobody can exercise it until expiration.

The difference between an American and European option is the difference between getting N chances to get it right N being the number of days 'til expiration and getting just one chance. For non-gold currency options, this is only when the carrying cost interest rate differential aka swap rate or rollover rate is high.

An option is an instrument that gives you the "right" but not the obligation to do something if you are long.

The more "rights," the greater the theoretical value of the option, all other things being equal, of course. That's just how options work. You could point to an ex post result, and and say that's not the case. But it is true ex ante. Differences in liquidity explain why American-style options are generally worth more than their European-style counterparts. As far as I can tell, no one mentioned liquidity in their answer to this question, they just introduced needlessly complex math and logic while ignoring basic economic principles.

That's not to say the previous answers are all wrong - they just deal with periphery factors instead of the central cause. Liquidity simply describes the ease with which an asset can be bought and sold converted to cash. Without going into the reasons why, treasury bills are one of the most liquid securities - they can be bought or sold almost instantly at any time for an exact price. The near-perfect liquidity of treasuries is one of the major reasons why the price yield of a t-bill will always be higher lower yield than that of an otherwise identical corporate or municipal bond.

Stated in general terms, a relatively liquid asset is always worth more than an relatively illiquid asset, all else being equal. The value of liquidity is easy to understand - we experience it everyday in real life. If you're buying a house or car, the ability to resell it if needed is an important component of the decision.

It's the same for investors - most people would prefer an asset that they can quickly and easily liquidate if the need for cash arises. It's no different with options. American-style options allow the holder to exercise liquidate at any time, whereas the buyer of a European option has his cash tied up until a specific date. Obviously, it rarely makes sense to exercise an option early in terms of net returns, but sometimes an investor has a desperate need for cash and this need outweighs the reduction in net profits from early exercise.

It could be argued that this liquidity advantage is eliminated by the fact that you can trade sell either type of option without restriction before expiration, thus closing the long position. Without putting an exact number on it, the general interest rate time value of money could be used to approximate the additional cost of an American-style option over a similar European-style contract. An option gives you an option. That is, you aren't buying any security - you are simply buying an option to buy a security.

The sole value of what you buy is the option to buy something. An American option offers more flexibility - i.

Since you have more options, the cost of the option is higher. Of course, a good example makes sense why this is the case. Options on the VIX are European style. Sometimes the VIX spikes like crazy - tripling in value in days. It usually comes back down pretty quick though - within a couple of weeks. So far out options on the VIX aren't worth just a whole lot more, because the VIX will probably be back to normal. However, if the person could have excercised them right when it got to the top, they would have made a fortune many times what their option was worth.

Since they are Euroopean style, though, they would have to wait till their option was redeemable, right when the VIX would be about back to normal. In this case, an American style option would be far more valuable - especially for something that is difficult to predict, like the VIX.

The value of an option has 2 components, the extrinsic or time value element and the intrinsic value from the difference in the strike price and the underlying asset price. With either an American or European option the intrinsic value of a call option can be 'locked in' any time by selling the same amount of the underlying asset whether that be a stock, a future etc.

Further, the time value of any option can be monitised by delta hedging the option, i. Instead, the extra value of the American option comes from the financial benefit of being able to realise the value of the underlying asset early.

For a dividend paying stock this will predominantly be the dividend.

But for non-dividend paying stocks or futures, the buyer of an in-the-money option can realise their intrinsic gains on the option early and earn interest on the profits today. But what they sacrifice is the timevalue of the option.

However when an option becomes very in the money and the delta approaches 1 or -1, the discounting of the intrinsic value i.

Then it becomes optimal to early exercise, abandon the optionality and realise the monetary gains upfront. For a non-dividend paying stock, the value of the American call option is actually the same as the European. The spot price of the stock will be lower than the forward price at expiry discounted by the risk free rate or your cost of funding. This will exactly offset the monetary gain by exercising early and banking the proceeds.

However for an option on a future, the value today of the underlying asset the future is the same as at expiry and its possible to fully realise the interest earned on the money received today.

Hence the American call option is worth more. For both examples the American put option is worth more, slightly more so for the stock. As the stock's spot price is lower than the forward price, the owner of the put option realises a higher undiscounted intrinsic profit from selling the stock at the higher strike price today than waiting till expiry, as well as realising the interest earned.

Liquidity may influence the perceived value of being able to exercise early but its not a tangible factor that is added to the commonly used maths of the option valuation, and isn't really a consideration for most of the assets that have tradeable option markets. It's also important to remember at any point in the life of the option, you don't know the future price path. You're only modelling the distribution of probable outcomes. What subsequently happens after you early exercise an American option no longer has any bearing on its value; this is now zero!

Whether the stock subsequently crashes in price is irrelevent. What is relevant is that when you early exercise a call you 'give up' all potential upside protected by the limit to your downside from the strike price.

Think of it this way, if you traveled back through time one month - with perfect knowledge of AAPL's stock price over that period - which happens to peak viciously then return to its old price at the end of the period - wouldn't you pay more for an American option? Another way to think about options is as an insurance policy. Wouldn't you pay more for a policy that covered fire and earthquake losses as opposed to just losses from earthquakes?

Lastly - and perhaps most directly - one of the more common reasons people exercise as opposed to sell an American option before expiration is if an unexpected dividend larger than remaining time value of the option was just announced that's going to be paid before the option contract expires.

Because only actual stockholders get the dividends, not options holders. A holder of an American option has the ability to exercise in time to grab that dividend - a European option holder doesn't have that ability. Consider the outcome X of a random walk process a stock doesn't behave this way, but for understanding the question you asked, this is useful:. Let's think of buying a call option on X. This has an expected value E[Y] that you could actually calculate.

For the moment, forget about selling the option on the market. The expected value is the same. Both are equal to X[N-1]-S. So you might as well exercise it and make use of your money elsewhere. If you exercise today, it's worth 0.

Therefore you should wait until tomorrow. Similar situation, but more choices: Again, you might as well exercise it now. In all 5 cases, wait until tomorrow. The market value of the option on day k should be the same as the expected value to someone who can either exercise it or wait. It should be possible to show that the expected value of an American option on X is greater than the expected value of a European option on X.

The intuitive reason is that if the option is in the money by a large enough amount that it is not possible to be out of the money, the option should be exercised early or sold , something a European option doesn't allow, whereas if it is nearly at the money, the option should be held, whereas if it is out of the money by a large enough amount that it is not possible to be in the money, the option is definitely worthless. As far as real securities go, they're not random walks or at least, the probabilities are time-varying and more complex , but there should be analogous situations.

By posting your answer, you agree to the privacy policy and terms of service. By subscribing, you agree to the privacy policy and terms of service. Sign up or log in to customize your list. Stack Exchange Inbox Reputation and Badges. Questions Tags Users Badges Unanswered. Join them; it only takes a minute: Here's how it works: Anybody can ask a question Anybody can answer The best answers are voted up and rise to the top.

Why are American-style options worth more than European-style options? So it makes sense that an American option is worth at least as much as a European option. Mathematically speaking, is there ever a good reason to exercise an American option early?

Don't forget it is an idealization and that even within that idealization, the equivalence of American and European options only holds for call options, not put options.

I don't think you understand what exercising an option means. It doesn't matter what happens to the share price afterward; you've still added to your capital.

You could close your stock position immediately after exercising the option and have an immediate cash profit if you wanted. And as for your reply to jdsweet - yes, it's true, you can sell the European option itself, I pointed that out explicitly, but there still has to be a buyer, and if he doesn't sell it, then he's out the money. American options at least have the potential to be exercised in-the-money even the share price eventually drops to below the strike.

A European option can never be exercised if that happens. Maybe you will have been lucky and sold it at the right time, but the option itself will have expired worthless. However, the purchaser of an American option may believe that, at some point between now and the exercise date, the price will change. Remember that once the option is exercised, the investor no longer has any risk. It is true that they could continue to hold the option to see if the price continues in the same direction, but then the cost of doing so would be the risk that the price change would reverse.

American options allow you to get out early. Grade'Eh'Bacon OK, but the value of a European option will normally never be below the in-money price anyway. If you want to get out early, you can't exercise the option, but you can certainly sell it for more than its in-money value.

Aaronaught 5 I think the OP is over-complicating with the idea that the purchaser of an American option would never sell early, under the belief that the price would continue in the same direction, up to the date of exercise. That may be true, if the option was purchased with the same mindset as a European option.

Clearly the purchaser of the European option has chosen the exact date of exercise in advance, based on whatever logic was relevant to them. However the purchaser of the American option has different motives - ex: I can't believe this answer has 11 upvotes! If we are in agreement that a European option is always worth at least as much as its in-the-money value, then exercising an American option early would gain you LESS profit than selling a European option.

You don't get N chances with an American option. Once you've exercised it, you get 0 chances. You might be thinking of binary options, where one-touch options American style ARE more valuable than price-at-expiry European style , but that doesn't apply to vanilla options. Grade'Eh'Bacon What you're saying doesn't make sense.

The purchaser of a European option knows he can sell it for more than the in-the-money value at any time before the expiration date. So, even if the option purchaser believed an event causing a price increase to a specific point would occur, he would be equally well served by either type of option. This person would not buy a European option.

Therefore, the market for European options is maybe only slightly smaller than the market for American options. As demand decreases, so does price. This applies to the initial sales market as well as the resale market.

OK, my fault for not doing more research. Wikipedia explains this well: The slight probability that this may occur makes an American option worth slightly more. But in order to do that you must have the capital to made the trade, hence the carry cost. Aron Thanks for this comment, it was very enlightening.

An American option gives you more "rights" to exercise on more days than a European option. Tom Au 5, 12 But, since you can always sell a European option for more than the in-money value, the additional right gives you nothing. It has no value. You can sell an American option for more than in-money value, also, and for more than the European option. The reason is that the American option can be exercised on more days. It is just wrong to say that "the additional right gives you nothing.

In other words, how does having the right to exercise on a day of your choice help you since you can always sell the European on the same day? The European option can be exercised only on one day, the maturity date.

The American option can be excercised on every business day between today and the maturity date; for a "day" option, that could be business days. You have more chances days to "get lucky" with an American option than with a European option.

You can always sell the European option for more than the profit of exercising the American option. No one has a crystal ball. The ability to exercise an option early gives liquidity and liquidity has value. You can still sell the European option early.

Jon S 1, 9 OK, but how do you mathematically calculate that value? And is it really an advantage? Early exercise is equally likely to lose money as it is to gain money, no? It's equally likely if you exercise it at a totally random time, yes. Think about it, though: If you assume that the share price fluctuates up and down, you are more likely to be in the money at some point over the lifetime of the contract then you are on the exact date of expiration. Aaronaught And, when it is, you can sell the European option for more than the value of exercising the American option.

If you're into math, do this thought experiment: Consider the outcome X of a random walk process a stock doesn't behave this way, but for understanding the question you asked, this is useful: Jason S 1 4 OK, the moment's gone.

If you include selling the option on the market, there's no advantage. Sign up or log in StackExchange. Sign up using Facebook. Sign up using Email and Password. Post as a guest Name. In it, you'll get: The week's top questions and answers Important community announcements Questions that need answers. You read too much Black-Scholes. MathOverflow Mathematics Cross Validated stats Theoretical Computer Science Physics Chemistry Biology Computer Science Philosophy more 3.

Meta Stack Exchange Stack Apps Area 51 Stack Overflow Talent.