Algorithm for trading stocks

Quantitative trading isn't accessible solely to institutional traders; retail traders are getting involved as well. While programming skills are recommended if you want to produce algorithms, even those aren't always required. Programs and services are available that write the programming code for a strategy based on the inputs you provide. But before any of this can occur, want-to-be algorithmic traders progress through several steps deciding exactly what they want to accomplish with the algorithmand how.

While a well programmed algorithm can run on its own, some human oversight is recommended. Therefore, choose a timeframe and a trade frequency that you are able to monitor. If you have a full time job and your algorithm is programmed to make hundreds of trades a day on a one-minute chart while you are at work, that may not be ideal.

You may wish to choose a slightly longer-term frame for your trades, and less trade frequency so you can keep tabs on it. Profitability in the testing phase of the algorithm doesn't mean it will continue to produce those returns forever.

Occasionally you will need to step in and alter the trading algorithm if the results reveal it isn't functioning well anymore. This is also a time commitment that anyone who undertakes algorithmic trading must accept. Financial constraints are also an issue.

Commissions rack up very quickly with a high frequency trading strategy so make sure you're with the lowest cost broker available, and that the profit potential of each trade warrants paying those commissions, potentially many times a day.

Starting capital is also a consideration. Different markets and financial products require different amounts capital. Market constraints are another issue. Not every market is suited to algorithmic trading. Choose stocks, ETFs, forex pairs or futures with ample liquidity to handle the orders the algorithm will be producing. Once the financial and time constraints are understood, develop or fine tune a strategy that can be programmed.

You may have a strategy you trade manually, but is it easily coded? If your strategy is highly subjective, and not rule based, programming the strategy could be impossible. Rule based strategies are the easiest to code; strategies with entries, stop losses and price targets based on quantifiable data or price movements.

Since rule based strategies are easily copied and tested, there are plenty freely available if you don't have ideas of your own. Quantpedia is one such resource, providing academic papers and trading results for various quantitative trading methods.

The rules outlined can be coded and then tested for profitability on past and current data. Coding an algorithm requires programming skill or access to software or someone who can code for you. The most important step is testing. Once a trading strategy has been coded, don't trade real capital with it until it has been tested.

Moleculin Biotech - MBRX | Trading Biotech

Testing includes letting the algorithm run on historical price data, showing how the algorithm performed over thousands of trades. If the historical testing phase is profitable, and the how can a casino host make money produced are acceptable for your risk tolerance—such as maximum draw down, win ratio, risk of ruinfor example—then proceed to test the algorithm in live conditions on a demo account.

Once again, this phase should produce hundreds of trades so you can access the performance. If the algorithm is profitable on historic price data, and trading a live demo account, use it trade real capital but with a watchful eye. Live conditions are different than historic or demo testing, because the algorithm's orders actually affect the market and can cause slippage.

Until it is verified the algorithm works in the real market, as it did in testing, maintain a watchful eye. As long as the algorithm is operating within the statistical parameters established during testing, leave the algorithm alone. Algorithms have the benefit of trading without emotionbut a trader who constantly tinkers algorithm for trading stocks the algorithm is nullifying that benefit.

The algorithm does require attention though. Monitor performance, and if market conditions change so much that the algorithm is no longer working as it should, then adjustments cheat code money in infinity blade 2 be required. Algorithmic trading isn't a set-and-forget endeavor that makes you rich overnight.

In fact, quantitative trading can be just as much work as trading manually. If you choose to create an algorithm be aware of how time, financial and market constraints may affect your strategy, and plan accordingly. Turn a current strategy into a rule based one which can be more easily programmed, or select a quantitative method that has already been tested and researched. Then, run your own testing phase using historic and current data. If that checks out, then run the algorithm with real money under a watchful eye.

Adjust if required, but otherwise let it do its job. Dictionary Term Of The Day. A measure algorithm for trading stocks what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

AlgoTrades - Algorithmic Trading Strategies - Algo Trading - Futures Trading System - Trading Algorithms - Automated Trading Systems - Quantitative Trading Strategies

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. How Trading Algorithms Are Created By Cory Mitchell November 12, — 2: Time Frame and Constraints While a well programmed algorithm can run on its own, some human oversight is recommended.

Develop or Fine Tune a Strategy Once the financial and time constraints are understood, develop or fine tune a strategy that can be programmed. Testing a Trading Algorithm The most important step is testing. Continual Maintenance As long as the algorithm is operating within the statistical parameters established during testing, leave the algorithm alone. The Bottom Line Algorithmic trading isn't a set-and-forget endeavor that makes you rich overnight.

Much of the growth in algorithmic trading in Forex markets over the past years has been due to algorithms automating certain processes and reducing the hours needed to conduct foreign exchange Willing to enter the tech-savvy world of algorithmic trading? Here are some tips to picking the right software. Algorithmic trading makes use of computers to trade on a set of predetermined instructions to generate profits more efficiently than human traders. Algorithmic HFT has a number of risks, and it also can amplify systemic risk because of its propensity to intensify market volatility.

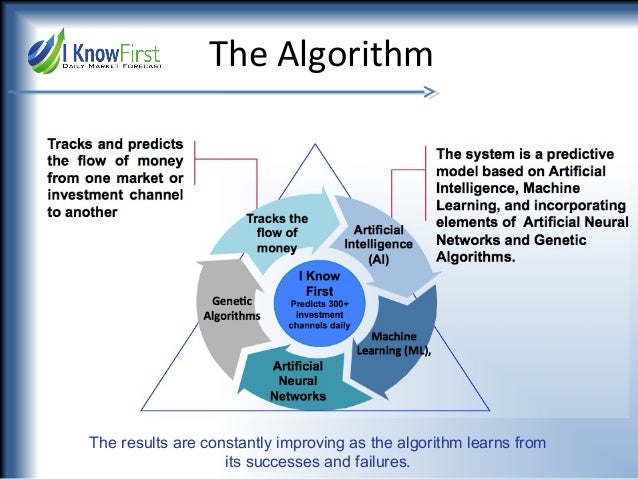

Ever wanted to become an algorithmic trader with the ability to code your own trading robot? Genetic algorithms are unique ways to solve complex problems by harnessing the power of nature. Some investors blame these earnings shocks on algorithms and ETFs. The vast proliferation of data and increasing technological complexities continues to transform the way industries operate and compete.

Learn the different job duties of a quantitative analyst and how much money an analyst makes; understand the skills needed to be successful at this career.

Learn how quantitative traders build the relative strength index RSI into their algorithms. Explore how automated trading Learn about how fundamental analysis ratios can be combined with quantitative stock screening methods and how technical indicators High frequency trading is an automated trading platform used by large investment banks, hedge funds and institutional investors An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers.

Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.