Different investment options available in india

Safe investments are one in which the element of risk is almost zero. Safe investments are good for those who are retired and would not like to take risk. There are many individuals who also do not have the ability to take risk, which is why they opt for some of the best safe investments in India.. Many individuals believe that if the investments are safe, there is likely to be very little returns that could come.

This is a myth. There are many investments, which are safe and at the same time, give you good returns. These returns can be with or withour taxes. We believe every individual needs to take a calculated risk. We have given a list of safe investments in India here below. We wish to state some of these have a higher lock-in periods for example the PPF, while others are taxable.

So, you have to take a call on which type of safe investments that you would like to invest. Go for the ones with the highest interest and a more long trem perspective. For example, bank deposits are now fetching you an interest rate of 6 per cent, whereas the savings account of Yes Bank is giving you an interest rate of 6 per cent, which is at par with SBI deposits.

Now, there is also a catch here. The fixed deposits are liable to tax, while savings bank interest is tax free up to a sum of Rs 10, So, while the interest is the same, the service and other aspects make Yes Bank savings account an ideal safe long term investment.

The banks fundamentals are also strong and hence making it one of the best long term investments. Go for it, if you have the money to spare. Post office monthly income scheme is for individuals who are less risk averse and looking for safe investment option with decent returns. This is again a scheme that has no benefits. It gives you a low interest rate and unlike the Public Provident Fund is fully taxable. So, your actual returns from the scheme turns out to be very low. If you are looking to invest in the scheme, you could look at various other options.

Presently, the Post Office Monthly Income Plan gives you an interest rate of 7. This is one of the best and the safest investment option in India, since it is guaranteed by the government of India.

PPF offers many advantages. The first is that the interest income is not taxable. The second is that there is tax benefits under Sec 80C of the Income Tax Act. It is a good way to save for your retirement. The interest rate on this has now dropped to 7.

There is a high possibility that the rates of interest could be even slashed further. However, if you are a long term investor, there is nothing to worry. The government has only recently cut the interest rate on the Public Provident Fund. This is one of the best safe saving instruments in India since it allows you to build a corpus as well for retirement.

The Indian government has taken several measures in various sectors for the benefits of the Senior Citizens. A Look at Senior Citizen Savings Scheme from ICICI Bank. The interest rate is decided by the government and will be set every quarter. The interest rates have now fallen to 8. The scheme can be opened in post office as well as banks such as ICICI, SBI etc.

As suggested by the name, it is important to note that this investment is only meant for senior citizens in the country. This is overall a good scheme, but one would have expected that the returns would not be taxable, given the fact that these are meant for senior citizens.

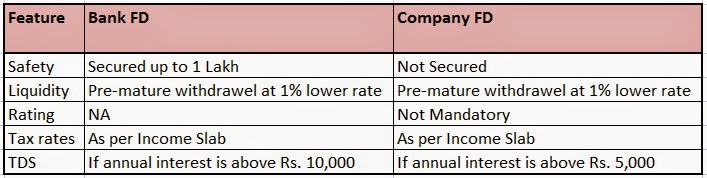

However, there are no tax benefits here. There is a TDS that would be applicable on these deposits. Bank fixed deposits are the most preferred financial instruments with interest ranging from 6 to 7 per cent depending on the bank you invest in.

Most of the banks recently have cut interest rates, making this a very dull investment proposition. It is important to remember that bank deposits are fully taxed in the hands of the investor.

So, if you are in the highest tax bracket your returns are expected to be very dismal. So, though these investments can be considered as safe, they are very low in returns. So, if you have other options look for those. Recurring deposits are another safe way to invest and generate regular monthly income. This is not very different from the bank deposits, the only difference being that here we invest small amounts every month in a very systematic way.

The amounts like fixed deposits are very much taxable, which does not make them a very attractive proposition You can invest in them if you want to save for regular purposes, but for tax purposes this is not a good investment.

However, you need to compare the interest rates before you invest, as these have undergone a change n recent times.

This account can be opened at post offices and commercial banks. There are several advantages of placing money in the Sukanya Samriddhi Account.

The first and the foremost is that you get tax benefits under Sec 80C of the Income Tax Act. The second is that you build a corpus for the girl child. If you are a long term investor, this is a great bet. The only worry is that the scheme has a very long term holding tenure, which is very high. The rate of interest on the scheme is currently 8. Debt mutual funds have the ability to give you superior returns than bank deposits, as they tend to park some money into equities.

Debt mutual funds are safe as they invest most of the money in debt instruments such as corporate bonds, government securities, fixed deposits of banks, money market instruments etc. These schemes are generally considered as debt free and can be placed, if one has a long as well short term objective in mind. Investing in tax saving fixed deposits will provide tax benefits under SEC 80C of the Income Tax Act.

15 Best Investment Options, Plans in India for beginners-Long & Short Term

Invested amount you can deduct the sum from your taxable income, thus it will reduce your tax liability. However, TDS is applicable on the interest income which exceeds Rs 10, in a financial year. Make sure you update the PAN in your account or else 20 per cent TDS is applicable instead of 10 per cent.

The interest rates vary from 6 to 7 per cent and have fallen in the recent past. Company deposits are also safe, if you invest in the AAA rated deposits. For example, some deposits like Bajaj Finance and Mahindra Finance are AAA rated and offer good scope for earning higher interest rates then bank deposits. Most of these can offer you up to 1 per cent higher interest rate. However, we suggest that these are good safe long term investments, there is an element of risk as well, as the nature of these deposits make them unsafe.

You can also consider what we call fixed maturity plans, which generally have a tenure of below 1 year. These are mutual fund units that are considered safe, as the amount is invested in safe AAA rated instruments. If you are looking for safe and best long term investments, this should not be a bad idea.

Look to invest for say at least a period of 1 year. It is only then that you could see some benefits in terms of profits. These are short term kind of instruments that can be considered as relatively safe.

So, go for it. Remember, that these are not tax free investments and are hence fully taxable in the hands of the investor. So, to that extent your returns are greatly reduced. If you are looking at a safe investment option, you should also consider the post office recurring deposit. The interest rates have dropped recently, but, this is a great option for investors looking at building a corpus for the long term. The one disadvantage that is worth mentioning is that these deposits are very much taxable in the hands of the investors.

However, there are relatively safe, if you have a long term perspective in mind. We suggest that you invest for at least 5 years, so as to lock interest rates at higher levels. One can also consider investment in select safe debt mutual fund schemes. These would offer you good investment opportunities for the more medium to long term perspective.

However, there can always be an element of risk as well, which you should not ignore altogether. In the past in one particular debt fund, there has been a default risk for a corporate instrument. So, it is not always that you get the best possible result from a debt mutual fund though they are considered as safe. If you are a retired individual, you should also be considering the post office monthly income scheme, as an investment option. Since these are backed by the government, they are safe.

In fact, we would not even say they are safe, but, they are the safest investment. However, there are some penalties that are applicable on these deposits if you withdraw them early.

For example, there is a 2 per cent charge that would be applicable on the same. However, if you are a retired individual it makes sense to invest in these schemes. So, go for the same, as they are fairly safe. These are also relatively safe investments from the debt mutual funds.

They are part of debt mutual funds, which largely invest their money in safe government schemes or high quality debt of mutual funds. Hence, they can be largely considered as safe. If you are a long term investor, then you should consider MIPS.

Know about Investments & Different Type of Investment Options

In the past there have been no instances of default or any other major problems in these schemes. Sometimes it is a blend of both equity and debt that these investors invest in. So, they churn out higher returns by mixing debt with equity. Some of these MIPs in the last one year have returned even 10 per cent.

Oneindia Classifieds Coupons Education News Movies Insurance Auto Cricket Gadgets Lifestyle Money Travel. Home News Business Stock Mutual Funds NRI EPF. Latest Articles How To Aadhaar PPF Income Tax. Investments Planning Taxes Insurance Spending. Daily Gainers Daily Losers Recent Dividends Open New Fund Offers Forthcoming Issues Closed New Fund Offers Reliance Mutual Funds SBI Mutual Funds HDFC Mutual Funds Birla Mutual Funds ICICI Mutual Funds Axis Mutual Funds Sundaram Mutual Funds IDFC Mutual Funds Tata Mutual Funds.

Bank Holidays in Karnataka Bank Holidays in Tamil Nadu Bank Holidays in Kerala Bank Holidays in Telangana Bank Holidays in AP Bank Holidays in UP Bank Holidays in MP Bank Holidays in Delhi NCR Bank Holidays in Bihar Bank Holidays in Maharashtra Bank Holidays in Rajasthan Bank Holidays in Haryana Bank Holidays in Goa Bank Holidays in Chhattisgarh Bank Holidays in Lakshadweep Bank Holidays in Manipur Bank Holidays in Puducherry Bank Holidays in Tripura Bank Holidays in West Bengal Bank Holidays in Jharkhand Bank Hoildays in Assam Bank Holidays in Odisha Bank Holidays in Gujarat Bank Holidays in Punjab.

BSE NSE Gainers and Losers Volume Toppers Advances and Declines Bulk Deals Block Deals IPO World Indices ADR GDR Listings Sector Watch BSE Sector Watch NSE Company Axis Bank Bajaj Auto Ltd Bharti Airtel Ltd HDFC Bank Hero Motocorp Hindustan Unilever Ltd.

ICICI Bank Infosys ITC Larsen Maruti Suzuki NTPC Ltd Reliance Industries Ltd State Bank of India Tata Motors Ltd Tata Steel Ltd Wipro Ltd. Gold Rates Gold Rate in Chennai Gold Rate in Mumbai Gold Rate in Delhi Gold Rate in Kolkata Gold Rate in Bengaluru Gold Rate in Hyderabad Gold Rate in Coimbatore Gold Rate in Madurai Gold Rate in Vijayawada Gold Rate in Patna Gold Rate in Nagpur Gold Rate in Chandigarh Gold Rate in Surat Gold Rate in Bhubaneswar Gold Rate in Mangalore Gold Rate in Vizag Gold Rate in Nashik Gold Rate in Mysore Gold Rate in Kerala Gold Rate in Pune Gold Rate in Vadodara Gold Rate in Ahmedabad Gold Rate in Jaipur Gold Rate in Lucknow.

Silver Rate in Chennai Silver Rate in Mumbai Silver Rate in Delhi Silver Rate in Kolkata Silver Rate in Bengaluru Silver Rate in Hyderabad Silver Rate in Coimbatore Silver Rate in Madurai Silver Rate in Vijayawada Silver Rate in Patna Silver Rate in Nagpur Silver Rate in Chandigarh Silver Rate in Surat Silver Rate in Bhubaneswar Silver Rate in Mangalore Silver Rate in Vizag Silver Rate in Nashik Silver Rate in Mysore Silver Rate in Kerala Silver Rate in Pune Silver Rate in Vadodara Silver Rate in Ahmedabad Silver Rate in Jaipur Silver Rate in Lucknow.

Bank FD Interest Rate Yes Bank FD Rate ICICI Bank FD Rate DCB Bank FD Rate IOB FD Rate Canara Bank FD Rate Karur Vysya Bank FD Rate Citi Bank FD Rate SBI FD Rate Union Bank of India FD Rate Indus Ind Bank FD Rate HDFC Bank FD Rate PNB FD Rate UCO Bank FD Rate Federal Bank FD Rate Dhanalakshmi Bank FD Rate Karnataka Bank FD Rate Corporation Bank FD Rate Allahabad Bank FD Rate IDBI Bank FD Rate Axis Bank FD Rate Kotak Bank FD Rate Dena Bank FD Rate Bank of India FD Rate Syndicate Bank FD Rate.

Bank RD Interest Rate. BANK IFSC Code CITY UNION IFSC Code DCB BANK IFSC Code DENA BANK IFSC Code DHANLAXMI IFSC Code IDFC BANK IFSC Code VIJAYA BANK IFSC Code. INR - Indian Rupee INR to USD INR to EUR INR to GBP INR to Dirham INR to Saudi Riyal INR to Qatari Riyal INR to CAD INR to ZAR INR to JPY INR to AUD INR to MYR INR to CHF INR to SGD INR to ARS INR to AWG INR to BAM INR to BBD INR to BDT INR to BGN INR to BHD INR to BMD INR to BOB INR to BRL INR to BSD.

USD to INR USD to EUR USD to GBP USD to Dirham USD to Saudi Riyal USD to Qatari Riyal USD to CAD USD to ZAR USD to JPY USD to AUD USD to MYR USD to CHF USD to SGD USD to ARS USD to AWG USD to BAM USD to BBD USD to BDT USD to BGN USD to BHD USD to BMD USD to BOB USD to BRL USD to BSD. EUR to INR EUR to USD EUR to GBP EUR to Dirham EUR to Saudi Riyal EUR to Qatari Riyal EUR to CAD EUR to ZAR EUR to JPY EUR to AUD EUR to MYR EUR to CHF EUR to SGD EUR to ARS EUR to AWG EUR to BAM EUR to BBD EUR to BDT EUR to BGN EUR to BHD EUR to BMD EUR to BOB EUR to BRL EUR to BSD.

AED to INR AED to USD AED to GBP AED to EUR AED to Saudi Riyal AED to Qatari Riyal AED to CAD AED to ZAR AED to JPY AED to AUD AED to MYR AED to CHF AED to SGD AED to ARS AED to AWG AED to BAM AED to BBD AED to BDT AED to BGN AED to BHD AED to BMD AED to BOB AED to BRL AED to BSD. SAR to INR SAR to USD SAR to GBP SAR to EUR SAR to AED SAR to Qatari Riyal SAR to CAD SAR to ZAR SAR to JPY SAR to AUD SAR to MYR SAR to CHF SAR to SGD SAR to ARS SAR to AWG SAR to BAM SAR to BBD SAR to BDT SAR to BGN SAR to BHD SAR to BMD SAR to BOB SAR to BRL SAR to BSD.

Here are a few best safe investments in India that investors could consider. Some of them are more for a long term investment perspective. Friday, May 19, , 8: Please Wait while comments are loading Enter the first few characters of the company's name or the NSE symbol or BSE code and click 'Go'.

Boost your returns from our latest financial news and tips! IFSC Code Currency Calculator. Type Domestic Domestic General Domestic Senior Citizen NRI NRI NRE NRI NRO. Goodreturns in Other Languages. Google Play App Store. About Us Terms of Service Privacy Policy Newsletters Apps RSS Advertise with Us Work for Us Contact Us Site Feedback Sitemap.

The "ONEINDIA" word mark and logo are owned by Greynium Information Technologies Pvt.